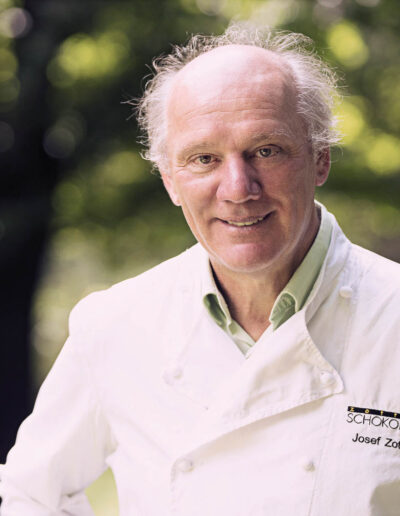

To talk about that matter we asked an expert who has seen quite a bit in the world of banking and money all together: Dr. Mara Catherine Harvey.

Ladies Drive: How important is kindness when it comes to working with money?

Mara: I’d say it’s super important. And I really say this from two perspectives. The first, of course, with my banking hat on and the second with my advocacy for gender equality and for the 17 Sustainable Development Goals (SDGs). When I say this with my banking hat it really has two dimensions. The first is the overarching belief that money can be a force for good. If we become more conscious about what we do with our money every day, respectively what we don’t do with our money, but we let other people do with our money, there’s so much more positive impact that we could have. So that for me is the first dimension of kindness and positive impact and mindfulness when we talk about how we deploy our money. Whether it is from a consumer perspective or from an investor perspective, from both angles you can make conscious choices.

When I look at it with my author hat on, in wanting to teach little children about money * one of my key messages is: money is a transmission of values, not just a transmission of value. So where are those values? How do we put the ethics back into money and how do we teach children to remain curious, to answer the question: where does my money go? We need to understand where money goes, not just `I use my money to get something`, but ‘my money is actually going somewhere, it’s doing something’. Where is it going, what is it doing and why should we stay curious about that? And for children to understand, there’s a good reason that you should stay curious about that, it’s called the 17 SDGs. There are 17 problems on the planet we want to fix and hence also the book on the SDGs for kids. For me this is putting kindness and putting ethics back into every aspect of money. It’s interesting that the topic of kindness comes up now, because a couple of years ago I was actually approached and connected online with a wonderful community in the UK called Kind Currency (kindcurrency.co.uk). I think the community was born in northern England and meanwhile it spread across the country, focusing on bringing businesses together who want to do something kind and who want to have a gentle, positive impact on the world around them and who are thoughtful and mindful of societies, communities and the environment. So I think the topic of kindness is one that as such is not new, but it’s one that is really gaining momentum as a counterweight to the, I would say, old-fashioned, outdated notions of pure capitalism, which is exclusively profit driven.

And greed driven.

Yes, exactly. So power, greed and competition are the values that were associated with money, in the past, still are today. And this is why we want to shift it from power, greed and competition to empowerment, equality and environmental impact. That is a massive shift. Why do we, why do I and why do we as VP Bank care about female financial participation? Because we know that for many women this is what money is about. It’s about what can I achieve with my money and what impact am I having with my money? And women ask themselves that question even more so than men do. So the more we can facilitate that women participate in financial decision taking, the more those values are going to be upheld in the financial decision taking.

Aren’t you afraid that maybe some people think that’s a stupid idea to put money with kindness and ethics – money is just something useful, hardware, it’s nothing that should be connected with feelings or emotions or anything. Are you maybe the only one thinking like that?

Look, I might be in the camp of the optimists thinking like this and there are many people who just say, well, more money for me is good for me and all the rest I don’t care about. However – the thinking around money and its impact is not a new one. You can trace this back centuries. Adam Smith, before he wrote «The Wealth of Nations» he wrote a book called «The Theory of Moral Sentiment». So the exchange in an economy amongst people has morals. You can never dissociate money from morals and money from ethics, you simply cannot. It’s only, that many people have chosen to ignore it.

As I experience the money business right now, there are no kind values, nobody is nice to each other. As soon as it comes to money it’s tough business, even aggressive, almost always with a bad connotation.

Indeed I think this is where we’ve lost our way with capitalism, going to the extreme of “it’s just about shareholder profit maximisation”.

Do we – thanks to the constant presence of moneytalk in the news, the internet and social media – also happen to think we know too much now about money? Is it better not to know so much where our money goes, a little bit more ignorant? It’s a balancing act. Weighing trust and transparency and how much do I want to know where my money goes.

I think it’s about two things. The 1st is transparency and the 2nd is really a matter of your beliefs, fundamentally. I think up until a few years ago the fundamental belief was I can either make money or do good. I think that that is genuinely shifting and I think it is also a generational shift. The younger generations do not see this as a trade-off. They’re thinking in terms of circularity, they’re thinking we can do business and we can do good. Also from an economic perspective, if you look at macroeconomic research over the centuries and over the decades and especially over the last century, there was a lot of debate about externalities. Economists have always highlighted the fact that most businesses, when they look at optimising their business and their profits, don’t factor in externalities. They don’t factor in how much does it cost the environment, how much does it cost countries far away where people are being exploited. There was always the absolute acknowledgement that any business has externalities. The only question was: do we factor them in or do we choose to ignore them? And sadly, too many people choose to ignore them because it’s just convenient and it’s just self-centred optimization. So, I don’t think that the topic is new. I think it’s just a question of how much importance is the topic being given today? And I say, thank goodness with the generational shift we’re seeing this topic come back to the forefront of the economic debate. I think too many people are actually tired of seeing an economic system that really benefits very few and damages so many. Because is there a need to damage other people? And again, it’s got to do with your fundamental belief when it comes to money. Do you just believe that money is something that you need to hoard to be well-off? Or do you believe that money is something that needs to be in a flow for you to be well-off? It’s not about how much you have at any given time, it’s about whether you have the amount that you need at any given time but then it can flow. And that’s a fundamental question about what people’s understanding of money is. If you see money in abstract from its societal and environmental impact, of course you can be oblivious to externalities and you just say, well more for me is good for me, full stop. But when you see the macro picture around money you have a very different understanding of what this is really all about. I would say sadly one of the things that have happened over the decades is that when we talk about macroeconomics, or when we talk about business administration, how many universities have killed history of economic doctrine from their curriculum.

I have no clue – a lot?

Lots. It’s one of these topics that was considered old fashioned. Why do we need to learn about the classics, why do we need to learn about Smith and Ricardo and Marx and you name them all? To understand their philosophies around money and to understand what’s worked, what hasn’t worked, why it worked, why it failed. We don’t study that anymore, in very few places this is still a priority. But if you don’t understand history, you also don’t understand what took us to where we are today. You also forget the important lessons of history. And then human beings have to learn by error all over again. Why is this not working for everybody? Why is it only working for very few people? I was privileged enough to study the history of economic doctrines which is maybe why I have this optimistic understanding of money being a force for good if we want it to be.

Do you have customers already asking for what they can do good with their money and be wealthy at the same time?

Absolutely. And I think we’re seeing that conversation shift. In my 23 years in banking, I only once encountered a person – who was a lady by the way, that was interesting! – who said “I don’t care at all. I just want to invest in a way that I can maximise my profit. Whether it’s oil, whether it’s tobacco, whether it’s weapons. I don’t care. If I then decide to do something good with my money, I’ll decide that separately.” But I would argue that the majority of the debate today is, if I’m given the opportunity to invest well in ways that have positive impact, as opposed to just investing well in ways that can have detrimental impact, if you make that possible for me, yes I want that.

Dr. Mara Harvey will be one of the exceptional key note speakers at our upcoming this year’s League of Leading Ladies (LLL) Conference May 27 & 28. And: We as Ladies Drive are over the moon to welcome Dr. Mara Harvey and the VP bank also as a new partner in our Ladies Drive World. Mara explains, why they choose Ladies Drive for a cooperation:

«We care about these topics, we care about female finance. We really are keen to partner on the League of Leading Ladies conference because the topic of the art of abundance is so dear to our hearts, that ties in precisely with female financial empowerment. And we know that the role that women play in the intergenerational wealth transfer that is in full swing, we know that more wealth than ever will transition from one generation to the next over the next decade and the role of women is key. This is why we are also committed to our Money Matters series together with Sandra to really encourage that conversation. And, last but not least, we very much look forward to teaming up with Ladies Drive on the Swiss Ladies Open (June 28–30 2024). Because this again is a platform for us also to promote young female talent and a platform to promote the fact that sports still has a long way to go before we can really see gender equality. Did you know that the women performing on the same level as the men in the golfing area make 8 to 10 times less than the men do for the same calibre tournament? Long way to go.»

Photo: Jonas Weibel.

Dr. Mara Harvey was born in England, raised in the Tessin and studied Political Economy in Fribourg, where she also did her doctorate. With Financial Parenting Masterclass (financialparentingworld.com) she developed the worldwide first course and toolkit, that teaches legal guardians how they can guide their kids on the right path to deal with money. Quite new is, that it’s common sense now to teach the kids at an early age, not just when they become teenagers. In the banking world Mara was working in a field that touched kids peripherally: Ultra High Net Worth Clients, families with a lot of money. During that time Mara noticed, that women are much less involved in the world of finance and she wrote her first book «Women and Risk: Rewriting the Rules» (Nicolai Publishing, 2018). The train of thought from women to kids wasn’t long: Mara then authored a rhymed book series for kids, the «Smart way to start» series (smartwaytostart.com). Each book tackles a money topic: saving, spending, earning, smart choices. Today, Mara is the CEO of VP Bank Switzerland.