Are you sure you can simultaneously handle a startup and childcare? Do you think there will be enough time to grow the business?“ These questions deviated sharply from what I hoped to discuss – my startup’s vision. It is to simplify the daily lives of millions and positively impact societal well-being. Yet, the investor seemed more concerned about my ability to manage my roles as a Co-founder and CEO and a young mother. „I thought I was well-prepared, but now I’m not so sure what to make of it,“ Anna expressed her doubts to Luca. Both of them, CEOs of their respective startups, alumni of prestigious universities, parenting young children, utilizing comparable technologies to solve real-world problems, and targeting similar market segments. Their ventures were at equivalent stages of maturity. The obvious difference lay in their gender.

„That’s quite odd,“ Luca responded. „In my recent pitch, the focus was on our growth strategies. One investor even empathized with me, sharing his own experience of balancing young fatherhood and entrepreneurship. He said it taught him to prioritize and make swift decisions.“ Just then, John, who had been listening to Anna and Luca’s conversation, interjected. „Excuse me for interrupting, but what you’ve just described, Anna sounds like a case of unconscious gender bias. I recently attended a workshop on this topic and ever since, I’ve been trying to raise awareness about it wherever I can.“

“Conversations like these occur far too often, which is why we, at the FE+MALE Think Tank, are dedicated to raising awareness around the topic of gender bias in startup funding through the Beat Funding Bias Initiative (BFBI).”, says Patricia Montesinos, Initiator of the Think Tank. “Together with our male colleagues, we want to unleash Switzerland’s dormant potential, drive job creation, and honor gender diversity as a catalyst for innovation entrepreneurship.”

Together with BFBI, our goal is to support both entrepreneurs and investors on how to deal with this issue and close the funding gap.

Patricia Montesinos

Scientific evidence displays the tremendous impact of unconscious bias on funding outcomes, especially when it comes to female-led businesses 1. Several months ago, our analysis on founders’ perceptions of gender bias in funding revealed significant insights. The results were quite revealing. Although the majority of founders were able to answer in a promotive way, a significant number of founders were still stuck in defensive language when talking about their ventures.

But what does promotive and preventive language entail? Let us quickly recap what we described in our previous article. On one hand, promotive language highlights growth and opportunity, conveying optimism. On the other hand, preventive language focuses on risks and problems, suggesting caution. The way founders speak can greatly impact an investor’s confidence and hence alter funding decisions in the startup world.

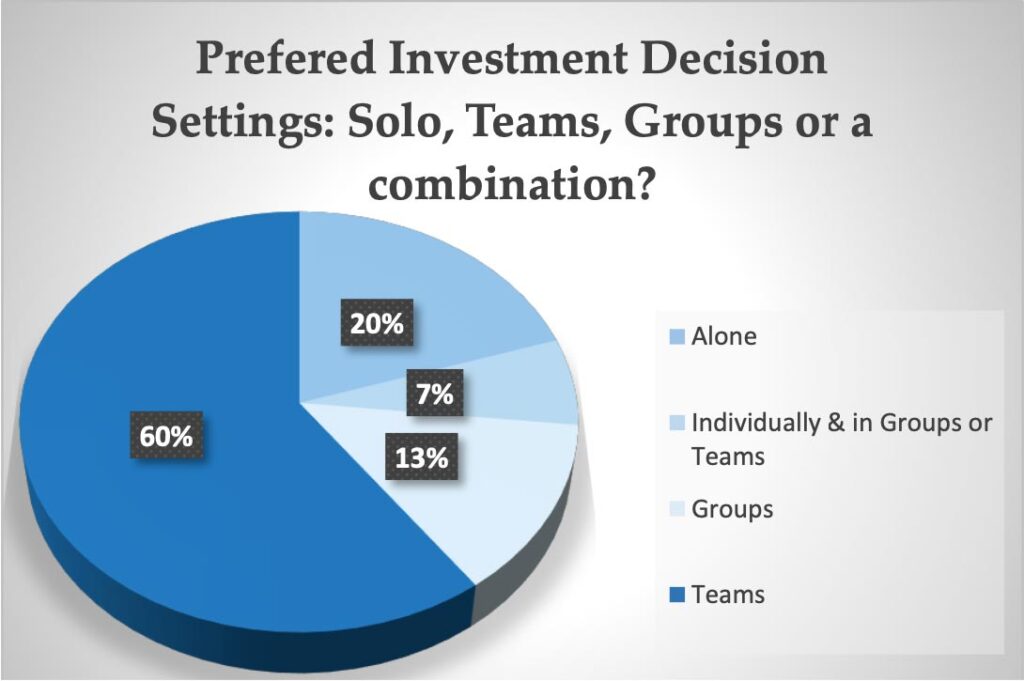

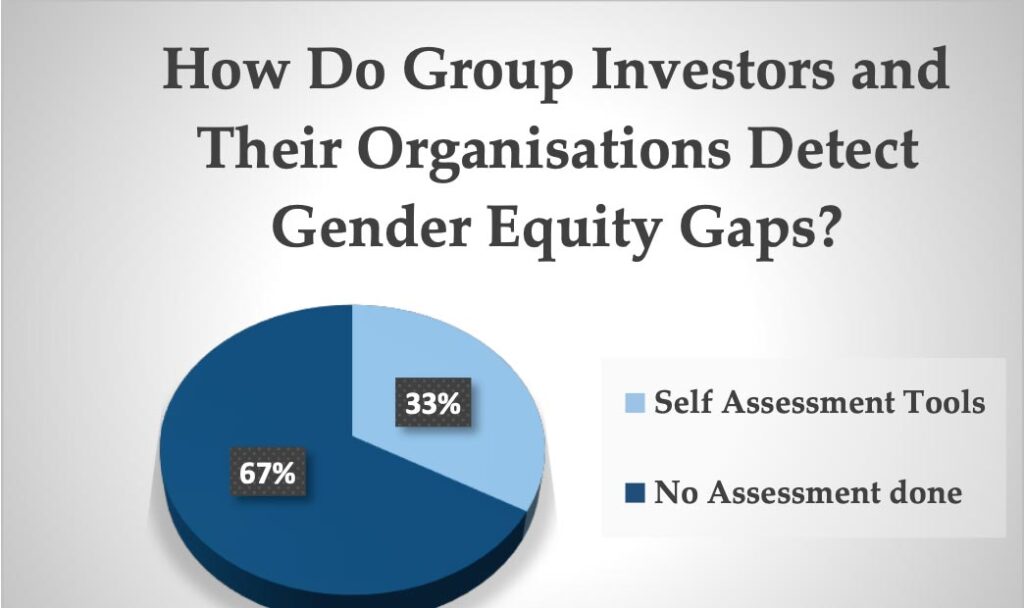

While analyzing the founder’s side of the equation, we also surveyed the side of investors. It revealed to us, that the majority of investors prefer to make investment decisions in groups or teams, rather than individually (Figure 1). The decisions made in groups can be subject to underlying unconscious group dynamics and biases, affecting the objectivity of the decision. Additionally, we asked group investors how they detect gender equity gaps in their organization. Astonishingly, the majority of investors do not undertake any assessment at all (Figure 2). At this point, we want to make it clear that the data presented in this article reflects a segment of the Swiss investment landscape and is not indicative of the entire investor community in Switzerland. These outcomes pushed us to extend our research, engaging with 14 additional investors who were open to speaking to us about the issue of gender bias in funding.

When we think of gender bias in funding, we often forget that the story has two sides. Besides affecting founders, the outcome of this bias also affects investors. In our interview, an anonymous Investor told us, that she was often faced with the question, of whether her husband was supporting her financially, while she and her co-founder were building up their business. Such kind of questions to female founders are not unusual. Giorgia Scetta, Materials Manager at Masschallenge Switzerland, became aware of gender bias in startup funding after discovering that on average fewer than 20% of startups have a female co-founder and less than 3% of funding has gone to female-led startups in the last few years. Despite the higher potential to outperform gender- homogenous teams in the long term. She acknowledges that female founders often encounter heightened scrutiny from predominantly male juries. Therefore, a key focus of Giorgia’s role within the accelerator is to consistently ensure startups are evaluated by a diverse jury. This holds true across all sectors, with particular attention to Femtech. In this field, Giorgia tell us, technologies primarily addressing female-related aspects might not be fully appreciated by an all-male jury. 2 3

Nonetheless, the belief in balance, in the equality of men and women-led businesses, and the complementarity of diverse teams is what motivates Investors like Nicolas Bürer to sharpen their awareness around this topic. He has encountered similar situations like our protagonists Anna and Lucas in the introductory story. Nicolas told us of his partner, who had a very difficult time raising funds. “However even if she’s assertive and ambitious, she sells differently than men. More on the product, less on the fantasy and big vision.” This leads us to the question if focusing on selling the product rather than the vision – a sales approach that may differ from men’s – could actually be advantageous. This is particularly relevant in periods of economic uncertainty, where establishing a credible product-market fit is crucial. Other investors like Thomas Heimann, Deputy General Secretary at SECA shared with us that male-led startups tend to secure funding at a rate 10 times higher than their female-led counterparts displaying the gap and the state of gender equality. As a result, he is committed to contributing positively towards achieving economic equality and closing the gap created by unconscious biases. “For heightened awareness of funding bias, I advise fellow investors to embrace a generational shift, as younger individuals often bring fresh perspectives and a more inclusive mindset. Engaging in roundtable discussions that include both males and females, as well as a mix of age groups, can foster open dialogues and challenge existing biases – equality should be the norm- not a topic for debate,” he added.

However, this isn’t the only perspective. We also heard from other investors who are motivated by a desire to deepen their understanding of decision- making processes and diversify their investment portfolios.

After exploring investors‘ personal experiences and motivations for combating gender bias, we turned our attention to learning what, in their view, defines a successful startup. From all the interviews, four key attributes emerged as essential for a startup’s success from an investor’s perspective. These include (i) a dynamic, diverse team with a passionate commitment to their vision, equipped with both (ii) technological and (iii) business skills, and ultimately, shared Thomas (iv) the potential of the business model plays a crucial role in determining success.

A meticulously executed, sustainable business model that demonstrates growth, resilience, and rapid creation of customer value is crucial. Additionally, the societal impact generated by the startup and the strength and support of its surrounding ecosystem plays pivotal roles. Arijana Walcott, Investor, and Co-Founder of DART, emphasized, “A startup that effectively solves a significant problem or fulfils a need in a scalable way measures success not just in financial returns but also in the ability to innovate, impact the target market, and maintain sustainable growth. Diversity in team composition can be a key indicator of such success.” This perspective is echoed by Naava Mashiah, Investor, and Founder of ME LINKS, who added “A successful startup means having a CEO capable of making tough decisions and a team that is agile.”

How can we overcome the disparity now? To mitigate we need to look at several attributes and stakeholders. As previously founders and investors are not the only ones who need to be taken into account. The Investor Jacqueline Ruedin Rüsch, Founding General Partner of Privilège Ventures, mentioned that the cultural gap plays a significant role in solving this issue. The statement results from the observation, that boys and girls are raised differently in our society and the said families and society create and sustain stereotypes. According to Nina Reinhart, Co-founder and Managing Director of Reinhart Capital, a supporter of female angels and female founders for many years, two mitigation strategies can be applied to decrease the effects of the cultural gap. First, educating both founders and investors, while also involving public bodies from the outset to highlight female success stories. Andrea Silberschmidt-Buhofer, Founder and Managing Partner of EquityPitcher notes that numerous business models led by women don’t fit the conventional VC framework, emphasizing the need for these female founders to recognize this mismatch and learn to effectively communicate in the language of venture capital. Accordingly, Cornelia Gut-Villa, Investor and Managing Director of Stiftung Startfeld believes, that universities and schools act as foundational platforms for promoting underserved fields like STEM in facilitating roleplay exercises. Carole pointed out: “The whole society needs to be aware of the gap, we need to display role models in media and bring case studies into schools. There is no reason for this gap to exist in areas like STEM. In China and in the Arabic States, I see more women in these fields than men.”

Beyond education, investors need to reflect on their questioning patterns and the diversity of those they engage. Further, they should make concerted efforts to empower more women with the authority and resources to make funding decisions.

Given all this information we then asked the investors what advice they would give founders who face preventive questions. Frédéric Lauchenauer, President and Managing Partner of Business Angels Switzerland, told us to reframe the preventive question with a promotive answer. From the feedback we gathered, a common thread was the recommendation to accentuate promotive factors such as business growth and team skill sets. Respondents advised converting cautious questions into discussions about possibilities and opportunities. Moreover, Jerome Michaud, Tech4Eva Coach/Mentor and Co-Founder at PhenomX Health told us that “focusing on your strengths and adopting a friendly attitude and growth mindset are crucial tactics for a favorable impression. It is also key to think about why an investor is asking you that question. Dig deep and try to understand the reason behind it. In the end, you should always ask yourself if the investor is the right fit for your startup.” Investor Carole Ackermann, CEO and Co-founder of DiamondScull added “stay true to yourself and seek an investor who believes in your idea.”

Having explored actions founders can take, let’s shift our focus to what investors can do to reduce unconscious gender bias in funding, Simon Enderli, CEO of the Swiss Entrepreneurs Foundation, suggests reading studies on the subject, using assessment tools, and increasing awareness. This fits the three-step process emerging from the answers we have studied. First is awareness—investors should observe their own questioning patterns and note any biases. This can be done by monitoring which questions they have asked to whom. The second step is education, where they can utilize self-assessment tools, read scientific papers on the topic, and participate in discussions or workshops. The final step is action; informed and educated, investors should then alter their business practices. Standardizing questionnaires to eliminate gender bias, proactively engaging with female-led startups, and promoting awareness, much like John in our narrative. Additionally, Katrin J. Yuan, Chair of the AI Future Council of the Swiss Future Institute and Board Member, suggests strategies like ensuring women have equal access to budgets and decision-making roles in various settings. Such as „to continously challenge the status quo, and invite and include 50% of women on tables with budget and decision power.“

In conclusion, the narrative we began with – highlighting the disparate experiences of Anna and Luca – serves as a powerful reminder of the persistent gender bias in the startup funding landscape. However, the insights from the investors and thought-leaders we interviewed offer a roadmap for change. By implementing strategies such as equal representation of women in decision- making roles, standardizing gender-neutral practices, and fostering a culture of awareness and advocacy, a more equitable and inclusive future in startup funding can be reached. To sum up, as Naava emphasized, „Diversity is crucial for profitability, so it’s important to consider women- led businesses and recognize our biases. We should all strive to be part of the solution, not the problem.“

The Beat Funding Bias Initiative (BFBI) (fe-male-think-tank.com)

- Kanze, D., Huang, L., Conley, M. A., & Higgins, E. T. (2018). We ask men to win and women not to lose: Closing the gender gap in startup funding. Academy of Management Journal, 61 (2), 586-614

- Teare, G. (2017, April 18). In 2017, Only 17% Of Startups Have A Female Founder Gené Teare. Crunchbase News. https://news.crunchbase.com/business/2017-17-startups- female-founder

- US VC female founders Dashboard | Pitchbook. PitchBook. (2023, November 2). https://pitchbook.com/news/articles/the-vc- female-founders-dashboard